How To Sell An Internet Business

Businesses are moving online faster than ever. In 2020, Covid-19 accelerated the growth of ecommerce by 4 to 6 years.

With traditional brick and mortar retailers struggling, moving a business online is becoming a safe haven in a world of social distancing.

So where do you look up online businesses for sale?

In this ultimate guide to buying and selling online businesses, we'll cover:

- The 7 best places to buy and sell online businesses.

- What to look for when purchasing an online business.

- The types of online businesses you can buy (and which are best).

- How to price online businesses to make more (or get a great deal).

Let's get started.

What Are the Best Places to Buy and Sell Online Businesses?

Here are my top picks for the best places to check out, buy, and sell online businesses for sale.

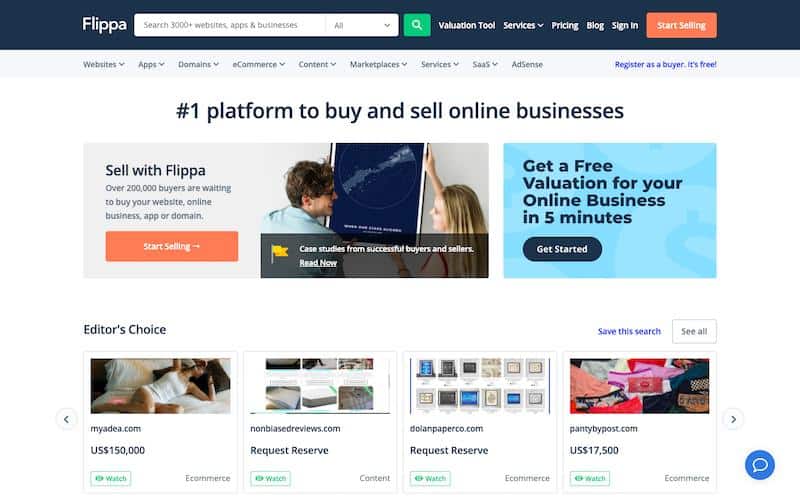

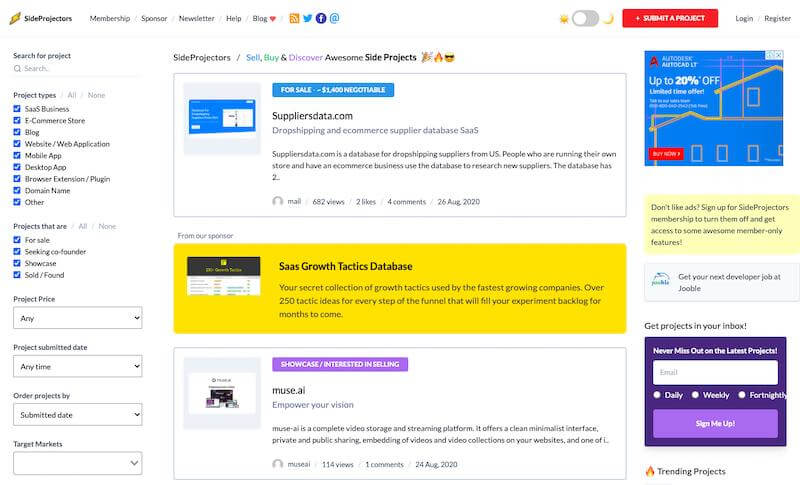

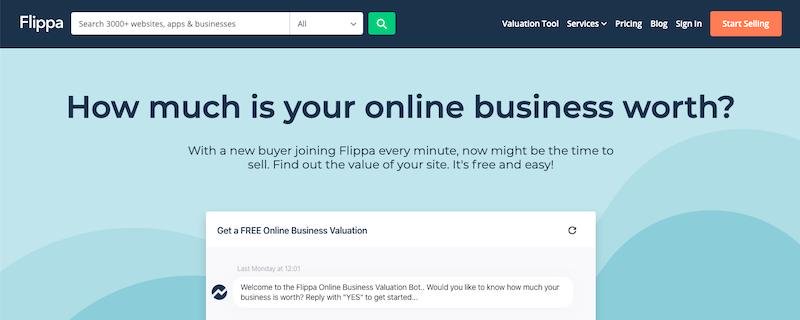

1. Flippa.

Best for buying and selling small online businesses.

Flippa is a platform for buying and selling online businesses, websites, domains, or apps. It's one of the most popular marketplaces to select the most suitable business to buy and sell.

For a buyer, it offers detailed insights into listed online businesses, including traffic, financials, analysis, channels, demographics, and more. You can even buy a detailed ' Due Diligence Report ' of online businesses to make an informed choice.

The Due Diligence Report includes:

- Seller analysis

- Financial analysis

- Traffic analysis

- Sales and marketing analysis

- Operations and legal analysis

- Industry and competition analysis

- Pricing analysis

- Risk assessment and recommendations

You can also use the 'Flippa Finder' service – an exclusive concierge service for first-time buyers. This service provides expert tips and professional guidance at a nominal fee of $50

Flippa covers all the needs of the sellers as well. You can list your business by filling all the relevant information. If you are trying to sell a blog or an eCommerce website, you can connect your Google Analytics with Flippa. It helps you showcase the proof of traffic and other key metrics on your website.

Besides, you can put your products into either auction listing or the classified listing. Auction listing has a period of 30 working days, while the Classified listing doesn't have any time limit. Additionally, Flippa offers a 'Website Broker' service to take the stress out of selling. The broker will take over the listing and present your business in the best light to increase your selling price.

Key Features:

- Financing to Small Businesses – Flippa partners with Guidant Financial to offer small business funding via SBA and 401(k) business financing solutions. The minimum requirement is $50,000 and a 690 credit score to become eligible for SBA Loans.

- Escrow – Flippa collaborates with Escrow.com to offer secure transaction services. The escrow process ensures that the buyer can review and validate the assets before releasing the seller's funds.

- Valuation Tool – Flippa offers a free online business valuation tool to determine your business's value accurately. It also provides insights on how to enhance your business' sellability.

- Diverse Categories – Flippa provides neatly segregated businesses into various categories, including apps, ecommerce, dropshipping business, services, SaaS, Content, and more, to help you find the right online business. You can further narrow down your search based on filters like age, price, type, etc.

Pros:

- You can sponsor your listings for better visibility on Flippa's home page.

- Buy templates and new businesses at lower prices.

- Flippa verifies all the buyers and sellers through legitimate government IDs.

- The Escrow Service protects all payments.

- You can also sell Amazon FBA retail stores.

Pricing/Fee:

Success Fees: The fee you pay would depend on your sale price.

- Up to $50k: 10% Success Fee

- $50,001 to $100k: 7.5% Success Fee

- Over $100k: 5% Success Fee

- Partner Broker: 15% Success Fee

There are fixed prices as well, including:

- Starter/Template Websites: $15

- Domains: $10

- iOS and Android Apps: $15

- Established Websites: $49

2. Shopify Exchange.

Best for buying businesses running on the Shopify platform.

Shopify Exchange is Shopify's marketplace for buying and selling ecommerce businesses running on Shopify. The business listing categories include industry type, location, business type, sales channel, and more. There's also an option to browse established businesses only directly.

You will see neatly listed online businesses on the first page.

You can view metrics like average revenue and profit per month without clicking on it. And if it's an ecommerce business, then it also reflects its inventory value.

Besides, you can create a public or private listing for your Shopify business.

Additionally, Shopify Exchange provides safe and secure transactions with anonymized messaging and Escrow money transfers.

Key Features:

- Starter Stores – There are tons of starter online stores listed on the Shopify Exchange for less than $100. You can pick a store with the potential to kickstart your business instantly.

- Secure Exchange – Shopify ensures safe and secure transfers of online businesses in partnership with Escrow.com.

- Staff Picks – Shopify offers a list of hand-picked businesses curated by its own staff to help you find a suitable online business.

Pros:

- It provides a free buyer's guide to help you know all the rules of trade.

- Gain access to actionable insights like traffic, demographics, profit margin, and more.

- Shopify properly scrutinizes online businesses to derive accurate analytics and traffic details.

- You can hide your business name and URL through private listing until your business gets sold.

- It comes with a free valuation tool to help you put the right price tag on your business.

Pricing/Fee:

Shopify Exchange charges a service fee based on your site's sales price. Service fee includes the Escrow fee and the estimated Exchange fee.

3. Empire Flippers.

Best for a personalized buying and selling experience.

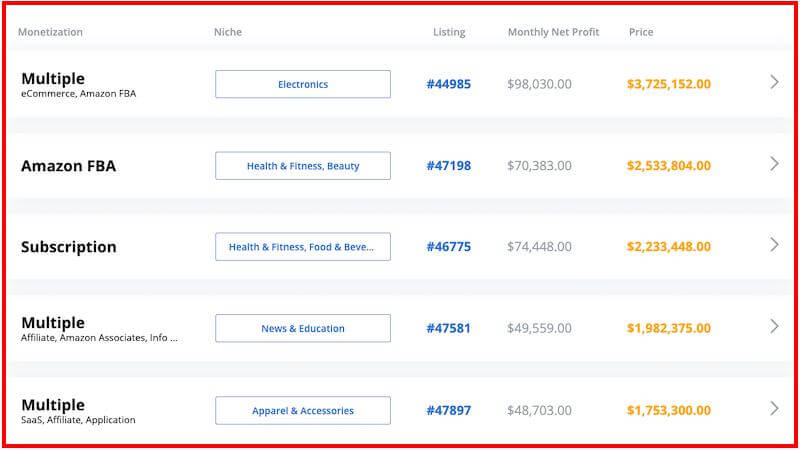

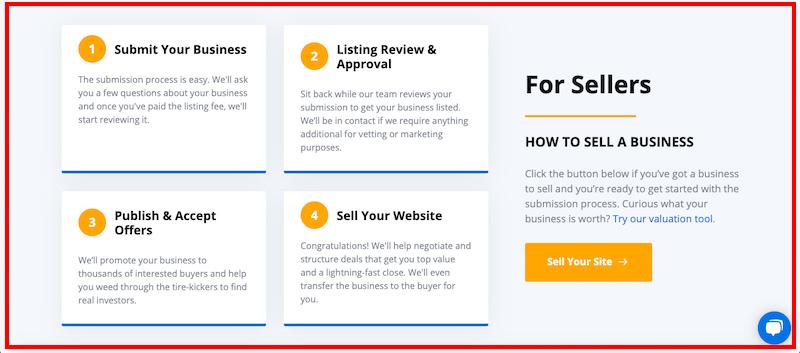

Empire Flippers is a marketplace for buying and selling online businesses. It minimizes the friction out of the dealing process by personally vetting both buyers and sellers.

The business listings on its home page reflect monetization methods, niche, monthly net profit, and expected price.

The buyer gets numerous other benefits like:

- Legitimate businesses: You get to choose from legitimate businesses only since Empire Flippers all the fake listing before they go live.

- Real Data: From the URL and Google Analytics to Profit and Loss Statement – it offers all the required details to help you make a data-driven decision.

- Migration: Their team will help you migrate the entire business after the purchase.

For sellers, Empire Flippers promotes listings to thousands of potential investors to find the right buyer.

Plus, it negotiates on your behalf to structure deals that are profitable for both parties.

Key Features:

- Monetization – Search for businesses based on monetization methods like affiliate, ads, dropshipping, ecommerce, etc.

- Refundable Deposit – You only have to pay a 5% refundable deposit of the value of the business you purchase. Besides, you get access to all the data you would need before making the purchase.

- Podcasts – Listen to an extensive library of podcasts of several business leaders and industry experts to make the right choice.

Pros:

- It can transfer the business on the seller's behalf.

- Find out the correct worth of your business through its free valuation tool.

- Call support to help you buy or sell quickly.

- Empire Flippers representatives set up conference calls between buyers and sellers for efficient communication.

- You can renegotiate the deal if the business earns less than 50% of the promised amount.

- New listings get posted every week.

Pricing/Fee:

Empire Flippers charges fixed listing prices:

- First time sellers: $297 listing fee

- Repeat sellers: $97 listing fee

The seller will receive 85-98% of the final sales price.

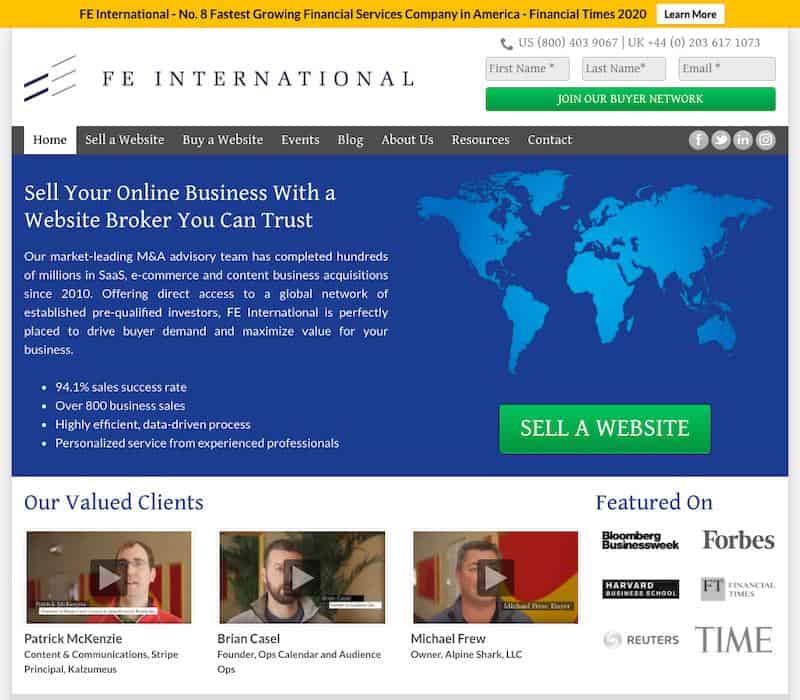

4. FE International.

Best for buying large scale online businesses.

FE International provides advisory services to a network of investors looking to buy and sell online businesses. This marketplace provides you easy access to established pre-qualified investors.

Moreover, you can choose from up to date listings with details like yearly revenue, net profit, and asking price. It also notifies "under offer" listings so you can avoid researching businesses that might get sold the next day. Plus, it helps you check out the benefits of buying a particular business in brief bullet points.

To sell your business, you can use its valuation service to determine your site's value.

Key Features:

- Global Network – FE International offers a global network of over 50,000 pre-qualified online investors to help you find the right buyer.

- Professional Broker – The professional brokers prepare a detailed prospectus with details like business opportunities, financial performance, traffic, and market trends. It helps you examine the businesses efficiently.

- Private Listing – You can make a private listing to protect your business interests during the sales process. This way, only serious and verified buyers can view your business information.

Pros:

- Qualified business brokers offer total assistance during the purchase and sale process.

- Its advisory service provides evaluation for your business.

- You can sell your business to international buyers without worrying about law and compliance.

- It offers private and confidential transfer of business on your behalf.

- FE International has offices in New York, San Francisco, Hong Kong, and London.

Pricing/Fee:

FE International charges a buyer transaction fee of 2.5% of the final sales amount. There's no listing fee. Other than this, you'd have to contact the supplier for the valuation fee quote.

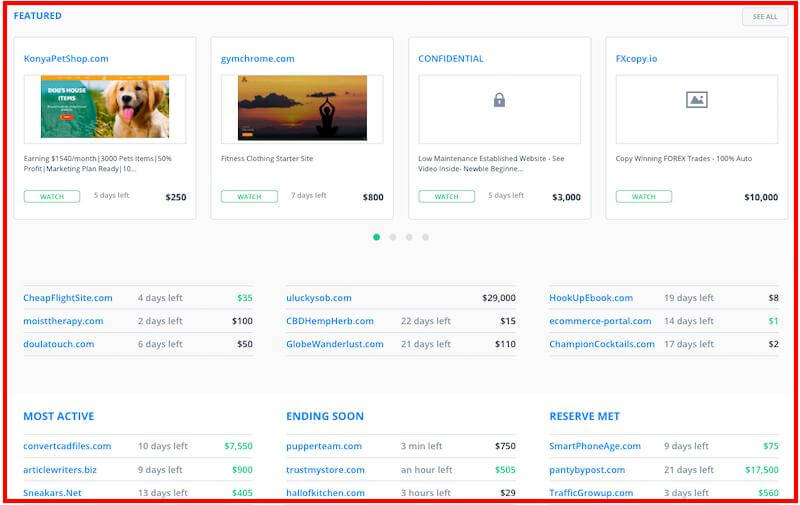

5. SideProjectors.

Best for selling or buying unfinished side-projects.

SideProjectors is a marketplace that offers a large inventory of side projects. It offers several business types, including SaaS, eCommerce, blog, website themes, mobile app, domain name, and browser extension. What's more, you can filter buying options based on project types, project status, price, submitted date, target market, etc.

After clicking on the listing, you can also fee further details like:

- Detailed project summary

- How the project was built

- Items included

- Reason for selling

- The ways the buyer can take this project further

SideProjector also helps you sell all types of projects – both finished and unfinished. This way, you can recover some amount of your capital investment.

Key Features:

- Co-Founder – It lists specific projects that are looking for a co-founder. It helps you find a partner for your entrepreneurial aspirations.

- Membership – Take its membership for $3 per month to gain access to benefits like customized project email alerts, payments powered by Stripe, direct messages, real-time alerts, no ads, and more.

- Sponsor – Increase your listing's visibility by sponsoring it for $10 per day. This will help get a guaranteed home page spot on weekdays. It takes only two sponsors a day to help you stand out from the crowd.

Pros:

- Search for projects based on different categories and types.

- You get real-time project deals on Slack.

- Integrate SideProjectors directly with ProductHunt to retrieve your project and fill all the required information.

- SideProjectors' moderators review all the projects before making them live.

- It promotes high-quality listings on the homepage, newsletter, blog, Twitter, and Facebook.

- Contact buyers or sellers through direct messages.

Pricing/Fee:

SideProjetors doesn't charge any buying or listing commission since it doesn't handle any payments. Basically, it's just a medium to connect buyers and sellers.

6. Digital Exits.

Best for buying and selling large tech businesses.

Digital Exits works as a website broker to help you sell your online business with $250k – $5m in yearly profit. It specializes in assisting the sale of large technology businesses. Plus, it comes with a team of advisors to help you maximize the value of your business.

To help you get the right buyer, Digital Exits offers features like:

- It helps you chalk out the right marketing plan.

- It prepares an executive summary for an impressive presentation.

- The advisors manage the entire deal – from the beginning until the migration.

Digital Exits also has the backing of a selected group of premium buyers with a buying capacity of $668.27 million. That means a potential buyer is probably a click away!

Key Features:

- Global Deals – It can help you sign international deals with investors all over the world. It has already completed deals with over 100 buyers in 5 continents, including Europe, Asia, North America, South America, and Australia.

- Copywriter Interview – In-house copywriters interview business owners to gather all the relevant information. After that, they draft an executive summary, compelling story, and edit the prospectus to make the business look attractive.

- Bank Financing – It gets bank financing for your business in advance to make it attractive for buyers with less net-worth.

Pros:

- It markets your business offer to 13 different marketing channels to get the right buyer.

- Digital Exists answers all the buyers' questions on your behalf.

- The buyers have to sign an NDA to keep your business information secure.

- It helps the buyer during the transition period to run the business efficiently.

Pricing/Fee:

You have to get in touch with the vendor for pricing details.

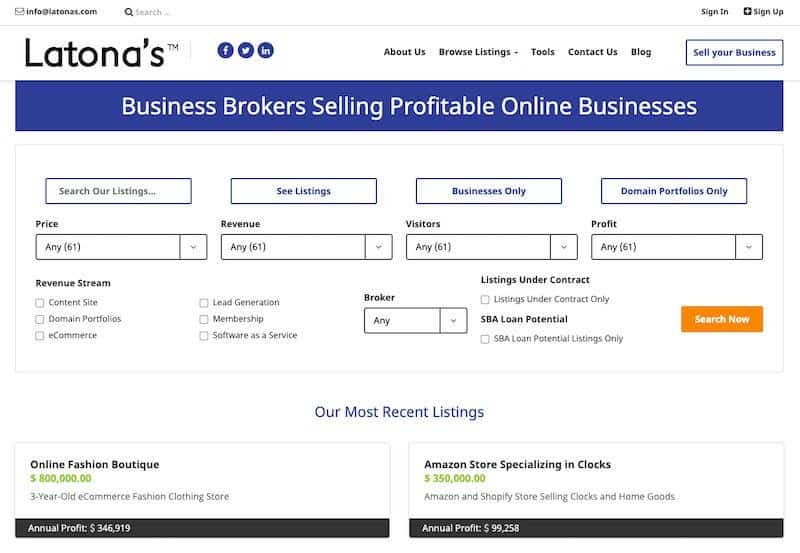

7. Latona's.

Best for selling profitable online businesses.

Latona's are mergers and acquisitions brokers specializing in buying and selling high-value businesses. From the online boutique and Amazon store to lifestyle and news media platforms – Latona's offers an extensive range of listings.

It doesn't charge any fees from the buyer either. Plus, it offers unique filters where you can specifically look for businesses with an SBA loan potential. For buyers shopping on a budget, it also has segregated listings under $3,00,000 category.

Additionally, Latona's provides a broker for every M & A to take care of all the buying/selling needs.

Key Features:

- Revenue Streams – It offers business listings based on multiple revenue streams, including domain portfolios, content sites, led generation, membership, eCommerce, and SaaS.

- Payment Plan Calculator – It helps you determine whether you should accept or offer a particular payment plan or go with a lump sum amount.

- Latona's InteLend – The intellectual property lender helps you get cash for your existing digital assets.

Pros:

- It offers easier contract management through smart integration.

- Track your favorite listing by pinning them on your dashboard.

- Latona's provides an extensive buyers network.

- Dedicated brokers ensure fully guided transactions.

- The vendor does the entire sales and transfer process on your behalf.

- The buyers have to sign an NDA to protect your valuable business information.

Pricing/Fee:

There's no upfront fee.

What Kinds of Online Businesses Can You Buy And Sell?

Here are the online businesses you can sell or purchase easily:

1. Content Sites/Blogs.

Nearly 2 billion blogs get published every year worldwide. In the United States alone, there are more than 30 million bloggers who post every month.

Naturally, most bloggers monetize their blogs and sites since most people now use the internet as an information source. Today, content sites and blogs are lucrative businesses that you can even buy and sell online.

Buying.

Buying a content site or blog needs in-depth knowledge about how website monetization works. However, you can work around the complexities by gaining firsthand experience. Whether you're starting a blog with WordPress or making a website with a popular website builder, it's important to know what you're getting yourself into.

After gaining experience, start looking out for websites that haven't been used or updated for extended periods. With any luck, you'll find a suitable site on marketplaces like Flippa, FE International, Empire Flippers, etc.

Meanwhile, use social media to announce your interest in acquiring a website. Once you identify potential choices, contact the respective owners to take your idea forward.

Before making the final purchase, it's crucial to tally your short-term and long-term plans with the website's owner.

At the same time, it's essential to purchase from a recognized vendor like Flippa.

Purchasing your site from a trusted vendor like Flippa comes with benefits like:

- Authentic metrics like website traffic, traffic sources, conversion rates, etc.

- Get a real picture of the website and how it influences purchasing decisions.

- Secure payment and transfer.

- Free migration after the purchase.

When you buy a website from individuals directly, ask them to prove the numbers behind their monetization claims. In such cases, a great way to avoid getting duped is by taking the advice of industry experts who can guide you better. They could also advise you on how to enhance visibility, improve traffic, and generate more passive income.

After you strike a deal, ensure there's a legal contract. You may know the seller and work out personal terms without pen and paper. However, it's better to draw up formal documents when it comes to doing business and exchanging money.

Selling.

The first step here is to estimate the value of your website.

You can evaluate your blog's worth by taking these factors into account:

- Cost of content development.

- Your annual revenue.

- Cost per visit.

- In case you don't have any annual revenue, you can make estimations based on the website's cost.

- Use statistics like website traffic and aspects like website design.

The good news is that many online marketplaces come with their own valuation tool to calculate your blog's worth automatically.

Take Flippa's valuation tool , for instance:

Once you make up your mind, list it in the 'For Sale' section of online website marketplaces.

You can also ask around for references if you know someone personally in the industry. Learn more about how to close business deals, and always go for written documentation over word of mouth.

2. Ecommerce Websites.

Statistics suggest that By 2040, 95% of all purchases will be via ecommerce stores. What's more, the ecommerce industry is growing at a rate of 23% YoY. Clearly, buying or selling an ecommerce website can be quite lucrative most of the time.

Buying.

Since the stakes are high, it's best to stick to facts while purchasing an ecommerce business. Focus on what the business 'is' instead of what it 'can be.'

Moreover, consider important metrics while buying an ecommerce site:

- Annual revenue

- Operating costs

- Brand awareness

- Cost of goods sold (COGS)

- Gross profit

Since it's likely to be a long-term investment, you might want to consider the site's long-term potential too.

Try to understand why the business is for sale. And if there's potential to increase the revenue, then why is the current owner selling it? Which ecommerce platform are they using?

You also need information about their order fulfillment service, dropshipping suppliers, and distributors. Simply relying on past partnerships may not be enough.

Dig deep into the kind of customers who visit the website and how much they spend on an average. Additionally, you'll also need to understand if most of the visits are organic or via paid marketing activities.

Let's look at an example:

Suppose the site generates $4,000 in sales everyday organically. It's a huge bonus for you. But what if you need to spend 60% of that on paid ads? Would it be worth it for you?

Thus, it's essential to identify what percentage of visitors are visiting the site organically.

Other than this, scrutinize the bank statements and P&L statements of the business. Plus, look for tell-tale signs about the business' health and align it with your own information.

One of the best ways to value a business is the multiple of earnings method. Here, you decide the number of years you're willing to wait for the business to reach the break-even point.

Here's how you value a business with multiple of earnings:

(Selling price of the business) / (Annual net income) = Years

So, if you are willing to wait four years for the business with an annual net income of $100,000, you can pay at most $400,000 to buy it.

Lastly, be careful of the expert conmen who can dupe you. Before taking a decision, carry out in-depth research about the business and listen to expert opinions.

Selling.

Valuing an ecommerce business built from the ground up isn't easy.

To maximize the value, you can tweak a few things like:

- Improve the website design and make it more aesthetic and appealing. It should align with the products it's selling.

- Increase the sales channels currently in use. It will offer better value to the future purchaser, and help you get a much better sale price.

- Try to minimize the COGS (cost of goods sold), so you can maximize your profit margin – another potential bargaining chip.

- Try to improve the website metrics like CTR and traffic, and organically build up a social media presence. Buyers will be willing to pay more for a business with the right networks.

While selling ecommerce websites, peer-to-peer recommendations also help. Therefore, use your contacts in the business to spread the word around.

And as always, never rely on word of mouth. Emphasize on drawing up legal contracts, preferably in the presence of an attorney.

3. SaaS Companies.

SaaS businesses get valued differently than other internet businesses. For one, they are entirely cloud-based and subscription-driven.

SaaS businesses are also highly lucrative since they're scalable and applicable to a wide range of businesses.

Thus, it's easy to sell and buy them online.

Buying.

When it comes to buying, there are usually two broad options – either private purchase or via a vendor. And there are a lot of factors that can influence the decision, disregarding your buying medium.

Some of the factors to consider while buying SaaS companies are:

- Consider Essential Metrics – As with every business, rely on numbers and hard facts. You should study and analyze P&L statements, operational costs, annual revenue, and profit margins. You can also ask for any marketing metrics like LTV:CAC, and ROAS. These metrics will influence key business decisions.

- The Pricing Model – Understand the pricing model and try to find out ways to make it better. SaaS business models offer many pricing plans, including multiple-tiered options based on customers' needs, flat pricing, etc. The number of existing customers and customer acquisition rates can also influence this decision. With the right model, it's possible to minimize churn rates and maximize value.

- Source Code – Access to the source code is another essential consideration in a SaaS business. It's the business owner's exclusive property, so find out how easy it is to transfer the legal ownership.

- Customer Acquisition Channels – SaaS businesses usually have five customer acquisition channels: organic, referral, direct, paid, and social. Find out the percentage of acquisitions made by each channel. A business that relies on either organic, direct, and social channels is likely to improve your bottom lines. However, a business that relies overtly on paid advertising is unlikely to be sustainable in the long-term.

- Look At The Scalability – Can you improve customer satisfaction, enter new markets, and offer new services? Would that allow a slight increase in the pricing? All these aspects will help you determine the scalability of the SaaS business you are looking to purchase.

Selling.

Selling a SaaS business may be more lucrative than you expect.

First and foremost, you need to consider the type of buyer who might buy your SaaS product.

Here are the types of buyers who usually buy SaaS businesses:

- Individuals

- Private portfolios

- Microfunds/Syndicates

- Private Equity

- Strategics

All these five types of investors usually fall in the $100K to $15M deal range.

After you discern which type of investors might buy your SaaS business, you need to evaluate your business.

Most SaaS businesses use two valuation methods:

- EBITDA

- Seller Discretionary Earnings (SDE)

SaaS valuation usually starts out with SDE but can change to revenue after a certain threshold. That's why the valuation can sometimes confuse even the business owners.

However, you can't evaluate your SaaS business properly without considering the revenue.

Plus, consult legal experts before making any deal since a SaaS business can easily get valued in millions of dollars.

4. Apps.

Facebook, an app barely 16 years old, has a net worth of around $530 billion today. It isn't the only successful one in the market. And at present, there are apps for just about everything.

With the number of mobile app downloads increasing by 45% over the last five years, buying an app now can be a terrific investment.

Buying.

Buying an app makes sense if you're looking to leverage its competitive advantage in the market. So the first step should be to identify the business area you want to address and the service you want to provide. After that, assess the kind of app you're looking for.

Not all app developers like the business end of things. Thus, apart from using your contacts to look out for potential sellers, you can also signup with online marketplaces.

While judging an app by its appearance and user-friendliness is essential, it shouldn't be your only concern.

You should also focus on aspects like:

- Whether it's a paid app or a free one.

- Estimated downloads.

- Monthly traffic of the app.

- The median age group of users.

- User reviews.

- Monetization channels.

Don't just settle for the words of the developer. Check out the metrics for yourself and understand the aspects that can help achieve your business goals. Plus, try to discern the areas that you can improve.

Other than this, try to understand why the owner wants to sell the app. Look out for any trouble with the source code, its working condition, and its ownership.

You might also want to get the industry perspective on the app's competitors and valuation. Since there are so many apps in the market, it's easy to get overcharged. For example, the average app listed on 'Apptopia' costs $7500. So if you're getting charged $15,000 for something similar, you can take a stand.

Selling.

App developers with no interest in the business side of things are prone to selling apps. If you're one of them, the first to do is send out the word through your acquaintances.

Online presence on social media can enhance your reach to potential customers exponentially. If you've got it, make sure to advertise your intentions.

However, putting a value on an app for sale isn't easy.

The pricing will vary based on a few factors:

- Whether you developed the app yourself or you employed a developer

- The annual revenue (including subscriptions, if any)

- The number of users

- Average downloads per year

Avoid overpricing your app since there are a large number of apps for every business or niche. The best idea is to keep it in sync with the industry-standard rate and be a responsive seller.

Because of the competition, it's essential to respond to emails, calls, and queries in time. Also, make sure to address all the doubts of potential customers politely.

5. Domain Names.

With all the world's businesses coming online, everyone requires catchy domain names to attract customers. There were 367 million domain name registrations in the first quarter of 2020 itself. Therefore, buying or selling the right domain names can have good business value in the present times.

Buying.

Naturally, you would want to choose an interesting domain name. It's the first thing that your audience will notice about your business, so you need to make it as engaging as possible. Plus, it has to be relevant to your business, unless you go for something abstract like 'Google.'

Besides this, check that it's not already in use by someone else, and there isn't any copyright infringement.

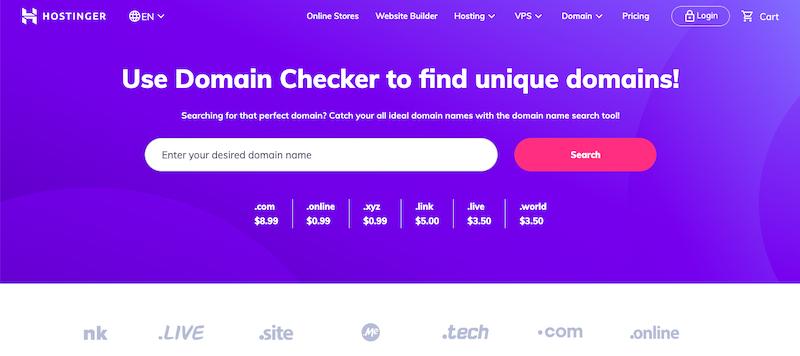

For that, you need to use domain name checkers like Hostinger Domain Checker.

You can find all the available domain names that are up for purchase. Plus, ensure that the name can reflect your business ethos and focus area precisely. You can proceed with the purchase once you select the domain name.

The entire process is quick since it's online and seldom requires a pen and paper. You usually get an email with all the details of the purchase, receipts, invoices, and an activation link.

Just log in, verify the account, and start using it right away.

Selling.

The first step here is to value your domain name properly. Just because you owned the business and ran it for some time doesn't mean it will sell for a high price.

You can start by referring to online marketplaces and analyzing the pricing of similar domain names.

Check out the domain name listings by Flippa:

You can observe the expected prices of domain names similar to yours and price it accordingly.

To sell your domain name, you either spread the word around through your industry contacts or list it on online marketplaces. Highlight your other business ventures and the merits of your business to make it more appealing.

Make sure you publicly list your contact information so potential buyers can reach you readily. Plus, ensure that you're always accessible via the WHOIS directory.

What Should You Look For When Purchasing An Online Business?

Not everyone likes the idea of starting an online business from scratch. Plus, buying an existing business comes with plenty of benefits. That said, the business you buy should have a proven history of revenue generation and immediate cash flow.

Here are some things to consider while buying an online business.

1. Monthly Traffic.

Monthly traffic is one of the essential metrics to look for while buying an online business. Additionally, look for diversity in traffic.

It should be a healthy mix of:

- Organic traffic

- Paid traffic

- Direct

- Social Media Traffic

- Referral Traffic

You can use tools like Google Analytics to find out how the traffic is coming to the store. Plus, check if the site has high-quality backlinks as such sites are worth more than sites with no or low-quality backlinks. In this case, you can use tools like Ahrefs and Open Site Explorer to look into a site's backlink profile.

2. Revenue Generation.

Taking the risk to revive a failed business is not worth it unless you are very skilled or experienced. Therefore, choose a business with growing revenue.

Ask for the financial data in monthly increments. It will give you a clear idea in which direction the business is heading.

3. Expenses.

Take a look at the expenses like website hosting, domain renewals, digital marketing, SEO, etc. At the same time, ensure that the owner is practicing smart spending habits. If not, you can reallocate spending to increase profits.

It's equally important to look for expenses that appear irrationally low or those that the owner didn't mention. Such expenses include payment processor fees, reimbursements for integrations & plugins, etc.

All in all, it's not a good idea to buy a business that requires more expenses than the annual income.

4. Growth Potential.

The business you are going to purchase may seem maxed out to its potential. But there are always some ways to add values.

Maybe the owner never hired a Conversion Rate Optimization service before. You can hire one and audit the business website for loopholes in the conversion process.

You can even start a dynamic social media marketing campaign. There are so many ways to try out and scale your business. However, avoid buying a business that shows little to no growth potential.

5. Find Out The Reason For the Sale.

Finding the reason why the owner is selling their business is crucial. If the reasons they give raise any red flags (like unprofitability or lack of traffic) – it's better to look for another business. Knowing the reasons will let you decide whether you can handle them.

6. Customer Reviews.

Finally, find out whether current customers are happy with the business or not. It will give you accurate insights into the business you are going to purchase.

It's better to purchase an established business, especially if you don't want to start a business from scratch. But look for the right things, lest you end up spending on an unlucrative business.

How Do You Price Online Businesses?

Here are a few steps to price your online business:

1. Identify The Business Model.

First, recognize the business model. There can be many of them online, including service or product-based, lead generation, advertising, subscription-based, and more. You need a business whose revenue model aligns with your short and long-term strategies.

2. Look at The Essential Metrics.

Next, you need to look into the balance sheets and the P&L statements. Plus, evaluate all the metrics like annual revenue, gross & net profits, and the COGS. They reflect the financial health of the business and determine its sustainability.

3. Different Modes of Valuation.

Valuation of a business can be taxing. Each business is different than the other, and so are the modes of valuation.

Take ecommerce business valuation, for example. In this case, most companies multiply annual revenue by a factor of 3 and arrive at the valuation. For online content sites or blogs, the final worth gets calculated by multiplying with 6. You may still not be sure, but this method can alleviate some confusion.

Other than this, you can also use valuation tools offered by most marketplaces like Flippa, FE International, etc.

4. Study Annual Expenses.

It makes sense to study and compare the total annual expenses with the annual revenue while buying an online business.

Investing in a business whose expenses can climb up to 75% of the annual revenue isn't a good idea. In such cases, the annual expenses might overtake revenue in a highly inflationary market.

Ultimately, an online business's proper pricing depends on your knowledge of the market, budget, and future goals.

Executive Summary.

If you decide to buy or sell a business, success depends on a lot of factors: the size of your business, annual revenue, marketing channels, branding, growth, metrics, and more.

If you want to attract international buyers, then FE International is an excellent option. Flippa is a great platform to buy or sell startups and small businesses easily. For large technology businesses and assistance with every aspect of the deal, I'd suggest Digital Exits.

My top pick is Flippa since it provides benefits like:

- Escrow service for secure payments.

- Most diverse business categories.

- Easy to navigate.

- The choice to hire a broker who can handle the entire process for you.

- Massive customer base.

The fact that it's one of the biggest marketplaces to buy and sell online business also makes it a great option.

Which online marketplace are you planning to use to check out online businesses for sale? Let me know in the comments below.

How To Sell An Internet Business

Source: https://www.adamenfroy.com/buy-online-business-for-sale

Posted by: pollardtractinglery.blogspot.com

0 Response to "How To Sell An Internet Business"

Post a Comment